We should say a-third-able instead of affordable housing.

Most people think of “affordable housing” as something built for poor people. Think about it. Why do so many of us tolerate outrageous monthly housing costs? Because it proves we are not poor. So, we spend ourselves into the poor house to prove we’re not … going there? Therefore “affordable” is no longer a useful way to discuss middle-class housing needs. It’s seen as something to move far away from, rather than embrace.

It’s like focusing on where you don’t want to go while riding a motorcycle. Experienced riders know that you go where you look. So, if you look at what you’re afraid of, you’ll run right into it. The same is true for money. If we focus where we don’t want to be, that’s still where we’ll go.

So instead of focusing where we don’t want to go (i.e.: housing for “poor people”) let’s shift our attention to where we do want to go. This engages our subconscious in helping us get there.

“A-third-able” is a concise way to say that the family home – yes, even their dream home – should not cost more than one-third of the monthly income of the people who live there. If, including utilities, dues, and taxes, it costs more than that, then it’s not a-third-able. If it costs less, it is.

Most everyday people want options and opportunities. They don’t want to be dumped onto waiting lists or forced to fill out reams of paperwork to prove they are “deserving” of a decent home in a convenient location. Most people like to live close to work. Is that so wrong? We all deserve the “luxury” of being able to shop around and find a home that suits us — not forced to accept whatever is offered by a government program.

The median (middle) household income in the U.S. is approximately $63,000 ($5,250 a month). This family likely has two breadwinners. Maybe one person has a full-time job paying $3,500 per month while the other has a part-time job or gig work to fill in budget gaps, while also leaving time to juggle kids’ school and social obligations. Their take-home, if they live in Idaho which has a small income tax, is likely 75% of net, which is $3,938 per month.

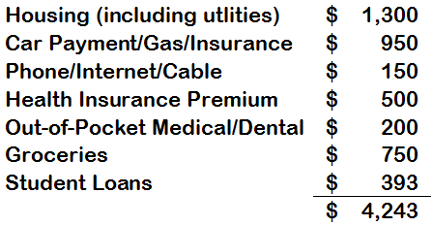

So let’s see how this shakes out in a typical household budget, using “a-third-able” as our max housing cost metric.

The amounts above are based on the most recent data. Given recent inflation, we should assume these costs are higher now. Health care costs were taken from a survey done by the Kaiser Foundation which assumes at least one earner has a job that offers family health benefits.

So we can see that the typical American family that has made no financial mistakes and has experienced no misfortunes (e.g.: disabilities, accidents, sudden death, divorce, etc.), still has to nip and tuck each month just to get by — even if they could find a suitable home for $1,300 per month!

What kind of house does $1,300 per month buy? After subtracting for utilities, insurance, and property taxes, there’s roughly $860/month left for the house payment. On a 30-year mortgage with good credit and 3% down, this buys a $185,000 house.

I’ll wait while you stop laughing.

Can you casually shop for $185k houses in your area and find plenty of options? If so, is it an area that offers jobs with benefits that pay enough for a typical family to achieve $63,000 per year in income? Are the jobs close enough to the a-third-able neighborhoods so that gasoline costs don’t bust your budget and wear out your car too fast?

If not, your housing is not a-third-able.

If what we focus on is where we go, then we need to focus on “a-third-able” housing which is where everyone needs to be, not “affordable” housing, which is where nobody wants to go.